We think differently

about asset allocation.

The only investor returns that matter to you are those you earn. Whether an index goes up or down daily is of less concern than how your portfolio fared over longer stretches of time. A portfolio thoughtfully allocated (and differently than most of the past) stands the best chance of success in the years ahead.

Over the past 40+ years, investors have largely benefitted from a “heads I win, tails you lose” bond market. Whether 50/50, 60/40, or 70/30 stocks/bonds, investors were rewarded by simply staying invested and rebalancing. At Head Investment Partners, we certainly agree that sustained success is more probable when one remains disciplined. But we simply do not believe that traditional allocations alone will garner the results they have in the recent past.

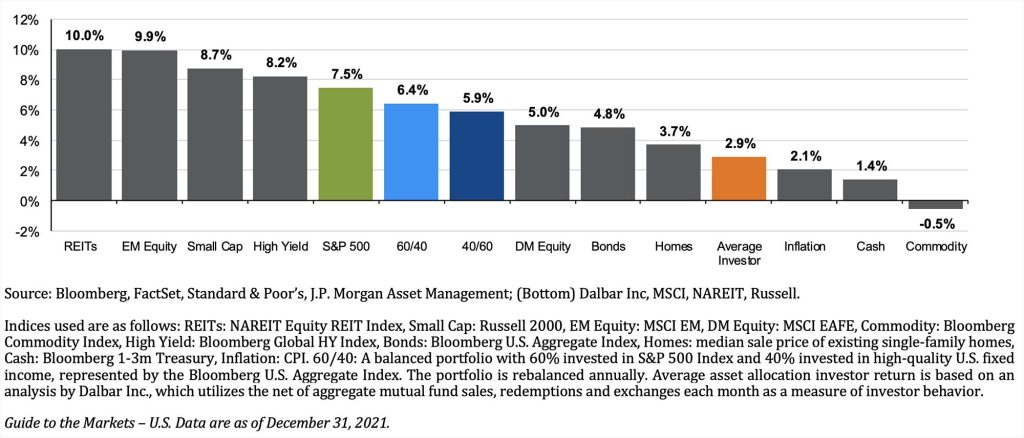

The chart below depicts the returns of the average investor versus those of several recognizable indices over the last 20 years (ended 2020). As you can see, being able to stay invested is a critical component of investor returns.

Why not just invest in passive strategies…haven’t they worked well over the last decade?

While most passive strategies have fared well in the post-Global Financial Crisis (GFC) world, passive strategies have no possibility of outperformance during market drawdowns like the Covid plunge of 2020

Passive strategies, by their very nature, will nearly always be overweighted by what has worked in the past (i.e. the biggest stocks most often carry the greatest weighting in the index)

- Wouldn’t it be preferable to overweight what we see working on a forward-looking basis?

- Wouldn’t it have been better to have been more heavily weighted to names like AAPL, NVDA, GOOGL, and AMZN when they were smaller and growing faster?

Passive bond strategies (i.e. that of high yield) most heavily weight the companies with the most high yield debt outstanding

- Is that the prudent way to invest in “junk” bonds?

- Do you not agree that a human can avoid mistakes that indices don’t?

Must we capture all the upside of the markets to reach our goals?

On the contrary, we firmly believe (and the data supports it) that the ability to realize better results is directly linked to one’s ability to endure the ride. A full-throttle index-only solution leaves an investor most vulnerable to poor behavior when it can be most harmful to them. According to research from Alliance Bernstein, capturing 70-80% of the upside of the markets in exchange for reduced downside exposure proves more palatable and outperforms over time.

As the chart below illustrates, digging out of a hole can prove challenging. We suggest a strategy focused on creating smaller drawdowns and resilience over time.

One of the greatest challenges in investing is maintaining a long-term vantage point during times of stress. How many of us wish they had picked up some of the bargains presented by the Global Financial Crisis? The same holds for periods of geopolitical uncertainty. Whether one harkens back to the Cold War, the Persian Gulf War, the 9/11/01 Terrorist attacks or the Covid-19 Pandemic in 2020, history has demonstrated that panic selling for long-term investors is not the answer.